What criteria do businesses need to obtain the incentives of Saigon High-Tech Park?

The tax incentives in Saigon High-Tech Park (SHTP) are among the most attractive tax benefits for businesses operating in the technology sector. So, what criteria do businesses need to enjoy the enticing incentives of SHTP? Let’s explore in the following article.

Tax incentives for businesses in Saigon High-Tech Park

Currently, SHTP offers numerous incentives for businesses operating within its premises, with the most prominent being tax incentives. This high-tech park is the largest attracting investment from many technology companies, establishing factories, and conducting operations here.

There are various types of tax rates that businesses can enjoy tax incentives on at SHTP, including corporate income tax, import-export tax, and value-added tax.

The tax incentives in Saigon High-Tech Park (SHTP) include benefits related to corporate income tax, import-export tax, and value-added tax

Corporate Income Tax Incentives

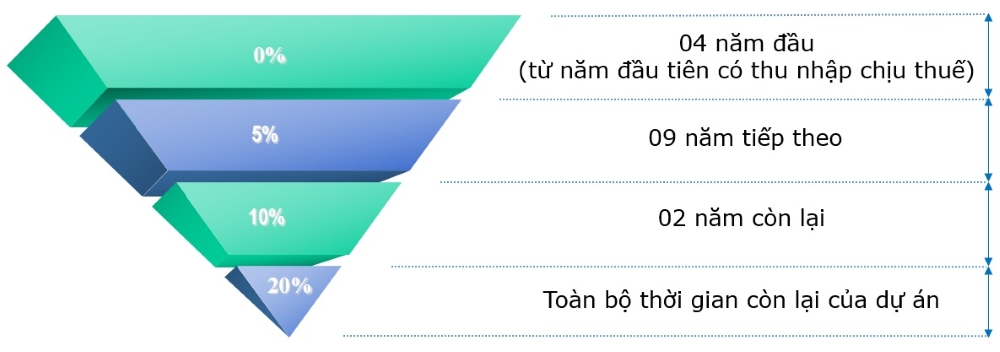

The corporate income tax incentives at Saigon High-Tech Park are stipulated as follows:

- Businesses operating in SHTP will enjoy a preferential tax rate of 10% for 15 years. In the first 4 years, they will be exempt from taxes, for the next 9 years, the rate will be 5%, and for the last 2 years, it will be 10%.

- For large-scale projects involving new technologies that require special emphasis on investment, as regulated by the Prime Minister, a preferential tax rate of 10% will be granted for 30 years.

- Projects in the fields of education, vocational training, and environmental activities will benefit from a preferential tax rate of 10% throughout the project implementation period.

Businesses enjoy gradually increasing preferential corporate income tax rates during their first 15 years of operation at SHTP

Import-export tax and value-added tax incentives

Businesses operating in the Ho Chi Minh City High-Tech Park will be exempt from import duties on imported goods used to create fixed assets for the project, including:

- Specialized equipment, machinery, and transport vehicles that cannot be produced domestically, and transport vehicles with a capacity of 24 seats or more, applicable to both land and water transport.0

- Components, spare parts, accessories, assembly fixtures, molds, and accompanying details for assembly with specialized machinery, equipment, and transport vehicles.

- Raw materials and supplies not domestically produced are used in the manufacturing of machinery and equipment in the production line, or for the fabrication of components, spare parts, accessories, assembly fixtures, molds, and detached details for the assembly of machinery and equipment.

- Raw materials and supplies not domestically produced are required for the production of products and construction materials are not domestically produced.

In addition, businesses are exempt from export-import duties and value-added tax for goods directly used in research and development activities. For high-tech products, both export-import duties and value-added tax are set at 0%.

>>> Learn more: Vietnam with the opportunity to become a leading nation in sustainable development of green office buildings

Land lease incentives

SHTP offers attractive land lease rates for businesses investing and operating there. Specifically:

- Land lease prices for production and service range from $0.6 – $1 per square meter per year in phase 1 and $0.4 – $2.3 per square meter per year in phase 2. Lease prices may vary based on the location and type of business.

- For businesses leasing land for research, incubation, and training activities, land lease rates are given the highest level of incentives, potentially reduced to 0.

- Investors make land lease payments in multiple installments over three stages. Precisely, investors pay 10% of the total land lease amount upon signing the lease agreement with SHTP, 40% upon receiving the investment certificate, and the remaining 50% within 1 year from the lease contract signing date.

High-tech parks can offer the highest level of land lease incentives, potentially reducing it to 0 for businesses engaged in research, incubation, or training activities

What criteria help businesses enjoy the tax incentives at Saigon High-Tech Park?

To qualify for the tax incentives at SHTP, businesses need to meet the following requirements:

- Alignment with the four priority development sectors, which include: Electronics and Information Technology – Telecommunications; Precision mechanics and automation; Biotechnology applied in pharmaceuticals and the environment; New materials, and new energy nano-technology.

Semiconductor electronics is one of the four prioritized sectors eligible for tax incentives at Saigon High-Tech Park (SHTP)

- The technology and products of the project must fall under the High-Tech Priority Investment Development List and the Encouraged High-Tech Products List. These lists were issued in Decision No. 66/2014/QD-TTg dated November 25, 2014, and Decision No. 12/2017/QD-TTg dated April 18, 2017, by the Prime Minister. Alternatively, the product/technology must be reviewed and recognized by the Scientific Council of SHTP.

- The total research and development operational costs conducted in Vietnam over three consecutive years must account for no less than 1% of the total annual revenue and over 1% from the fourth year onward.

- The average revenue from high-tech products over three consecutive years must be no less than 60% of the total project revenue for small and medium-sized enterprises and no less than 70% from the fourth year onward.

- The number of employees with a university degree or higher directly involved in research and development projects must be at least 5% of the total workforce for small and medium-sized enterprises. For enterprises with total capital exceeding VND 100 billion and over 300 employees, this ratio must be at least 2.5% (at least 15 people).

- Adoption of regulated quality management systems (ISO, CMM, GMP, etc.).

- Compliance with Vietnamese environmental protection laws.

The investment registration process at SHTP takes about 2.5 months, including 10 days for technology clarification, a maximum of 45 days for registration and issuance of investment certification, and 30 days for activities guiding compliance with construction and planning regulations at SHTP. Investors will not incur fees for receiving the investment certification.

>>> See more: What is the definition of a Tech Hub? Why do businesses choose to set up offices here

The semiconductor electronics company BESI (Netherlands) was granted an investment certificate at Saigon High-Tech Park in November 2023

Conclusion

The article has compiled essential information about the tax incentives at Saigon High-Tech Park, favorable land lease terms, and the criteria that businesses need to meet to enjoy SHTP’s benefits. For any inquiries or clarification on investment matters at SHTP, investors can contact the Management Board of the High-Tech Park for assistance.

Mr. Minh Hoang

Management Board of Saigon High-Tech Park

Lot T2-3, Saigon High-Tech Park, District 9, Ho Chi Minh City

Phone: (84-8) 3736 0291 (110)