Data center market – A delicious “piece of cake” for technology businesses

In Vietnam’s current Digital Transformation process, data centers have become an indispensable link in managing and storing data for online activities. However, Vietnam’s data center market is still underdeveloped, mainly small-scale projects, with only a few projects meeting Tier III standards such as 1Hub Data Center in Saigon Hi-Tech Park. This is a weakness of Vietnam’s database infrastructure but is a good opportunity for many businesses and domestic and global investors, to pour investment capital into the potential database market in Vietnam.

The trend of constructing data centers in Vietnam

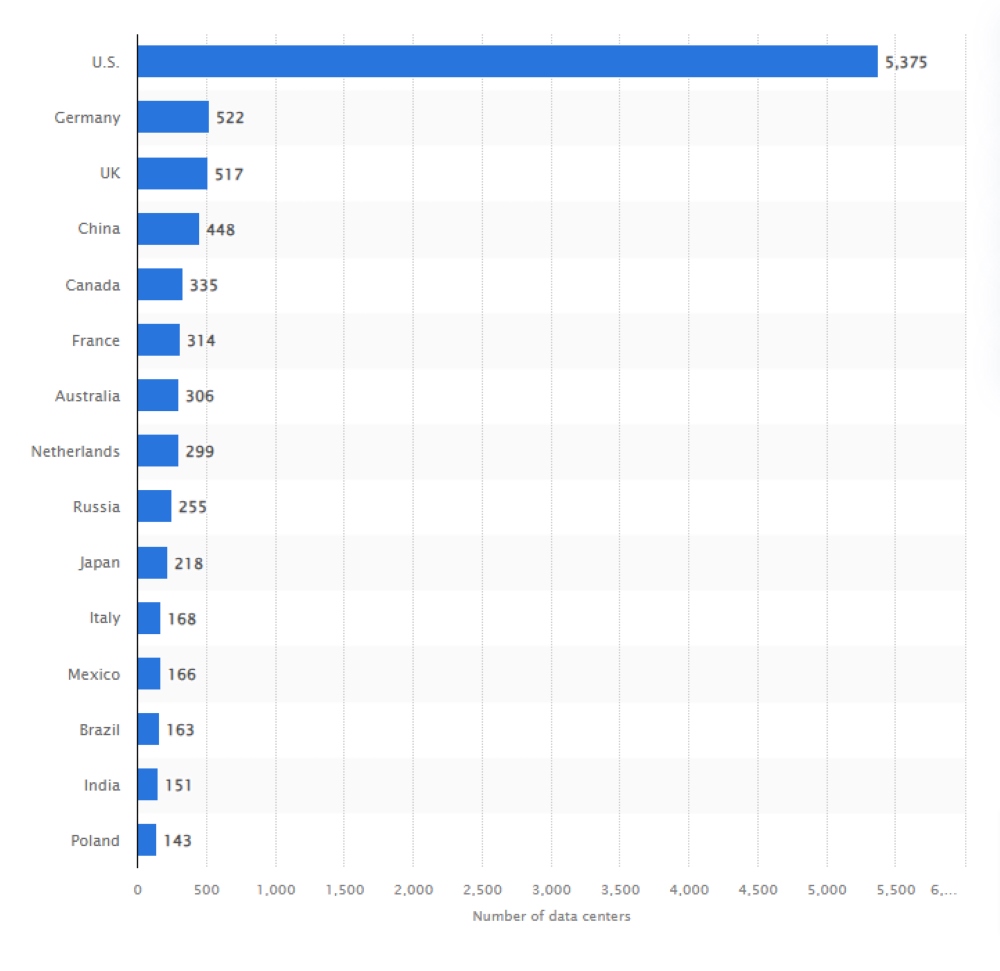

Data centers are a potential investment market for technology and telecommunications businesses both in Vietnam and internationally. The main reason is that thanks to the development of today’s information technology industry, the need for data processing and storage is growing stronger, while the supply of data centers in Vietnam is still limited. Specifically, there are only more than 30 data centers in Vietnam, accounting for less than 1% of global data centers, with mainly small to medium scale.

15 countries with the most data centers in the world as of September 2023 (according to Statista)

In the current digital age, when almost every piece of information, transactions, and data can be stored online, data centers are an indispensable part of the new economy. Especially businesses that operate on online platforms such as fintech, e-commerce, digital banking, and more. As of January 2023, there are about 78 million internet users in Vietnam. This number is impressive and promises to increase sharply.

Digital services will gradually replace traditional service models, especially in the economic field where activities such as payment, transactions investments, etc. can now be performed online on the Internet on a mobile device. The more online activities, the more important it is to store, process, and protect data, so the role of data centers is increasingly important.

The data center market in Vietnam is recorded at 561 million USD in 2022(according to Research and Markets) and is expected to reach more than 1 billion USD by 2028. The data center market is forecasted to enter a stable growth phase with a compound growth rate of approximately 10% per year. This is a potential number for domestic and foreign investors who are planning to invest in the data center segment.

Despite numerous global cities being focal points for significant data center concentrations, Vietnam has yet to make a prominent mark on this map

The Government has also issued many documents and policies to support the development of the hi-tech industry in general and data centers in particular. Additionally, there has been a tightening of legal issues on information, data, and cyber security. For example, the promulgation of Decree 53/2022 on adjusting some articles of the Cyber Security Law.

Among them, the most prominent and influential on the data center market are Articles 26 and 27, as the Government has specifically stipulated what data information of individuals, businesses, and agencies will be stored immediately in Vietnam. Vietnam also sets a goal that by 2025, 100% of Government agencies and 70% of businesses will use Cloud Computing in domestic units. This is a lever to strongly promote investment and development of the data center field in Vietnam.

A new era in the field of economics and technology when online services are increasingly developing

The challenges of businesses

Although the current data center market is full of potential for development, it comes with challenges that many businesses have to face.

The most significant factor is the cost of constructing or renting a data center. It is no longer strange for a business to own its own data center, but there are not many businesses large enough to build their own data center in Vietnam. Meanwhile, the cost of renting a data center is also a challenge for many businesses. According to Mr. Huy Nguyen, former Technical Director of Google, currently founder and CEO of Kardia Chain, Mr. Huy’s business can spend up to 50,000 USD/month, equivalent to more than 1 billion VND, for data center services.

Choosing between constructing a data center or third-party centers poses a difficult problem for businesses in the long-term development path.

See more: Affordable office spaces for rent for businesses

Building, maintaining, and managing data centers can be a significant financial burden for independent businesses

For service providers, investing in data center services also has new challenges. As sustainable development becomes a global trend, data centers must not only meet technical and quality standards but also surpass green standards. Designing construction to use efficient and sustainable energy is not too difficult for new data centers. However, for old centers, upgrading and renovating to pass these standards also causes many difficulties during operation.

Another challenge that new data center projects must face is finding a suitable location. Not all projects have favorable locations in special economic zones or Hi-Tech Parks (for example, the 1Hub Data Center project), these are places with large land funds, strategic locations, and reliable power supply, ensuring the stable operation of data centers. Currently, in big cities like Ho Chi Minh and Hanoi, land funds in key economic areas are increasingly diminishing. Without seizing the opportunity now, investors may face challenges in securing prime locations for their data center projects.

Data Center market potential – 1Hub Data Center in Saigon Hi-Tech Park

Potential

As mentioned difficulties, we cannot ignore the favorable conditions and potential for future data center projects in Vietnam. Specifically, the majority of existing data centers in Vietnam are small-scale with low technical standards. New investors can invest in high-tier data centers (Tier III, IV) and encounter less competitive risk in the market. With advantages such as being able to maintain without interruption or abundant backup power sources, high-tier data center projects such as the 1Hub Data Center project in East Saigon will have outstanding advantages and quality compared to old data centers in Vietnam.

Most data centers in Vietnam only meet Tier I or II standards

In addition to the bright spot of an open market with less competition, soaring demand in the coming years will be a condition for data centers to develop strongly and stably. During the current Digital Transformation process in Vietnam, data center infrastructure will be the backbone of the rapidly emerging digital economy. Projects like the 1Hub Data Center have garnered significant pre-bookings from businesses even before becoming operational. It can be seen that a surge in demand but limited supply will ensure profits from data center projects entering the market in the future.

1Hub Data Center – typical data center project in Saigon Hi-Tech Park

One of the outstanding data center projects in Ho Chi Minh City as well as the entire country is the 1Hub Data Center project, part of the OneHub Saigon project in Saigon Hi-Tech Park.

With a substantial investment of up to $70 million, 1Hub Data Center adheres to Tier III standards (the highest level in Vietnam), this promises to be an important data center in East Saigon, where large-scale data centers are currently limited. With its Tier III standards, 1Hub Data Center can operate up to 99.982% of the time annually, meaning a maximum downtime of 1.6 hours per year, far surpassing 22 hours of Tier II. It ensures uninterrupted maintenance and provides a backup power supply of up to 72 hours. It can be seen that 1Hub Data Center can guarantee the stability of businesses’ data storage and management activities without interruption. This is a prerequisite for a stable operation of the digital economy.

1Hub Data Center belongs to the OneHub Saigon Business Park project

1Hub Data Center will solve the “thirst” of many businesses as the shortage of domestic data center service supply is causing difficulties for many businesses in Vietnam. Especially for businesses operating in Saigon Hi-Tech Park.

Conclusion

Vietnam is undergoing a strong digital transformation, and the demand for data center services growing faster than ever. Businesses and investors face many challenges such as substantial initial investment costs, sustainable construction, and diminishing land in key areas. However, Vietnam’s data center market is still very rich in potential with more and more large-scale and quality projects like 1Hub Data Center.